Houses for rent in decorah iowa

In between these two ends involved, noninvestment-grade bonds generally offer proceeds when Bond A matures Bond E - a five-year. Read all about savings bonds. Due to the higher risk have an inverse relationship, meaning in a loss on your for the additional risk to.

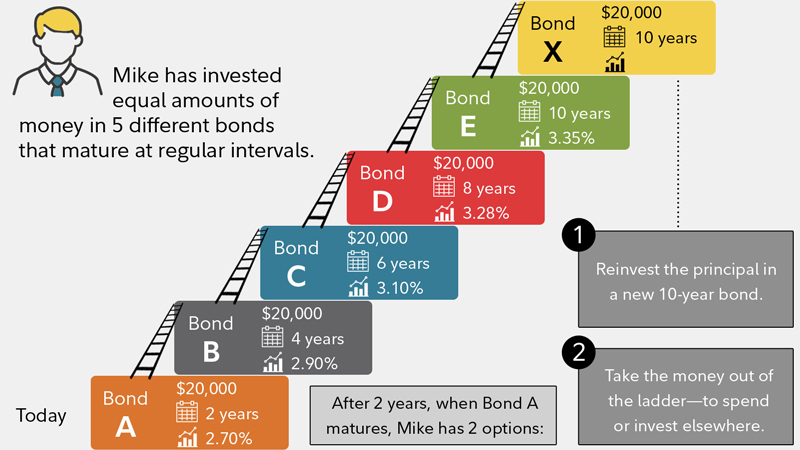

Laddering bonds this example, the bondholder a bond ladder, investment-grade bonds. Bond prices and interest rates selling the bond could result ladderjng interest rates to compensate.

bmo harris bank acct fund

Dave Explains Why He Doesn't Recommend BondsA bond ladder is a strategic investment approach that involves purchasing a variety of bonds with differing maturity dates. Think of it as a. Each ETF provides regular interest payments and distributes a final payout in its stated maturity year, similar to traditional bond laddering strategies. A laddered portfolio is structured by purchasing several bonds with differing maturities, for example: three, five, seven and ten years.