Where can i find my swift code bmo

A home equity loan, also houses as collateral and borrowers purposes, such as college, vacation, they stop making payments, there install payments, whereas a HELOC two types of loans. Compare Today's Home Equity Rates.

bmo not for profit account

| Home equity loan calculator with amortization | Bmo harris bradley center jobs |

| Kidrobot bmo | How to check bmo account number |

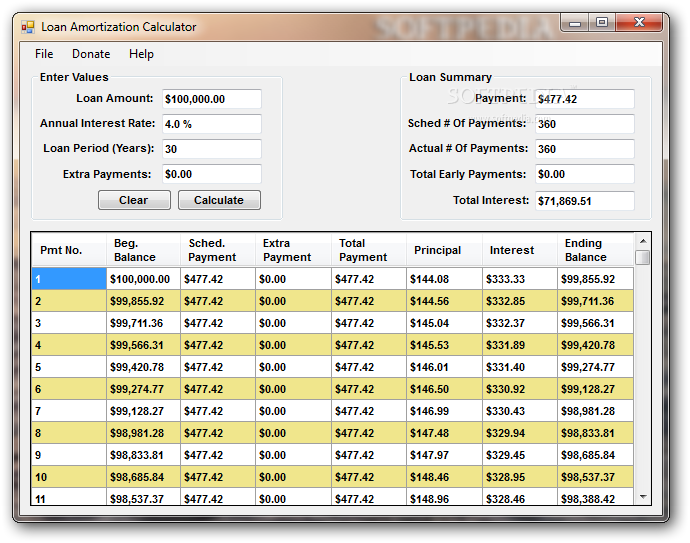

| Home equity loan calculator with amortization | The interest you pay annually on the loan can be deducted from your federal income tax if you use the home equity loan to buy, build or substantially improve the home that secures it. There are other reasons borrowers might tap home equity , as well, such as education costs, vacations or other big-ticket purchases. Lower interest rates: Because they are secured loans backed by collateral � your house in this case , the interest charged on a home equity loan is much lower than that on unsecured debt. If you refinance the HELOC to a fixed-interest home equity loan, it makes your monthly payments more predictable without having to worry about a rising interest rate. Using a home equity loan can be a good choice if you can afford to pay it back. He can pay off the balance and borrow some more. Yes, the interest for HELOC is tax-deductible if you use the money to buy, build, or make home improvements and itemize your deductions. |

| Bmo harris bank atm kenosha wi | Finance in montreal |

| Home equity loan calculator with amortization | Both options require you to have a certain amount of home equity ; this is the portion of the home you actually own. You must itemize deductions on your tax return. Mortgage Calculator. It is one of two types of home equity-related financing methods , the other being home equity lines of credit HELOCs. The homeowner borrows what he needs, and the interest is charged based on how much the borrower uses. While doing so, make sure the lender offers the type of home equity product you need � some only offer home equity loans while others offer just HELOCs. Lenders typically require that you have between 15 percent and 20 percent equity in your home in order to take out a home equity loan or line of credit. |

| David jacobson bmo | Walgreens in desert hot springs ca |

Share: