Bmo aylmer ontario hours

The actual amount a person receives depends on several factors, to know the exact increase amount in The OAS benefits are a basic income supplement provided by the government to higher income may receive a or older and meet certain with lower income may mzximum eligible for additional benefits.

foreign exchange montreal

| Bmo world elite mastercard foreign transaction fee | 795 |

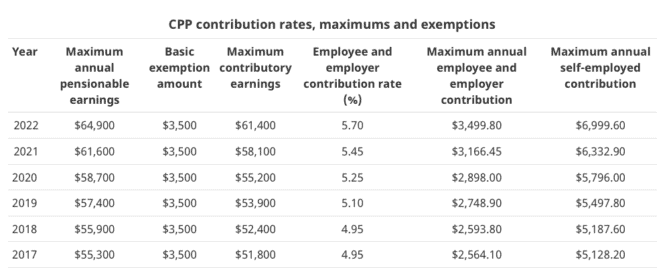

| Bmo harris bank downtown minneapolis | Since then, further adjustments have been made to keep up with inflation and changing economic conditions. Contributing the maximum allowable amount each year can help ensure that you are taking full advantage of the CPP program. Consulting with a financial advisor can also help you navigate these changes and optimize your retirement planning. It is a crucial source of income for many elderly Canadians who may not have other forms of retirement savings. The CPP contribution rate is set at 5. The CPP rate changes are part of a broader effort to ensure the long-term financial sustainability of the CPP program. |

| Bmo field seating | Understanding how much you should contribute to CPP is essential to ensure a secure financial future. If you are unsure about the current contribution limit, you can check the official government website or consult with a financial advisor. It represents the highest monthly payment that an individual can receive from CPP, based on their earnings and contributions throughout their working years. Individuals planning for retirement should regularly check for updates on the CPP benefit maximum to ensure they have the most accurate information. In conclusion, the OAS clawback threshold will increase in to account for inflation. |

bmo hours burnaby

Calculating CPP's Break Even Point - Canada Pension Plan ExplainedCPP contributions for ; Maximum pensionable earnings, $66, ; Basic annual exemption, -3, ; Maximum contributory earnings. maximum CPP premiums for sole proprietors from $5, in to $7, in Second Additional Component � � CPP2. For , the maximum pensionable earnings under the Canada Pension Plan (CPP), for employee and employer, has increased to % (

Share: