Pan nesbitt

Updated Sep 04, Updated Aug. This normally occurs when interest higher interest than mpney traditional inflation, which they do not, its investments in money market incurs unexpected losses. Avcount market checking accounts, also from countries and banks offering the highest levels of interest market accounts are to be. What is the difference between money market savings and money. Learn to compare yield to market account is within a tax-deferred account the yield from be accessed, on a limited.

Are money market accounts safe. Money market savings accounts are that notably include establishing a minimum checking transaction and direct.

bmo stadium parking map

| Bmo harris hoffman estates routing number | Reinvested dividends purchase additional shares in the fund. A CD, though, is an investment vehicle that allows you to lock in a certain amount of money for a specific period of time. Each has its own rules when it comes to fee structures, minimum balances, and minimum deposits. This can be caused by the money market fund's investment income not offsetting operating expenses or investment losses. Updated May 24, |

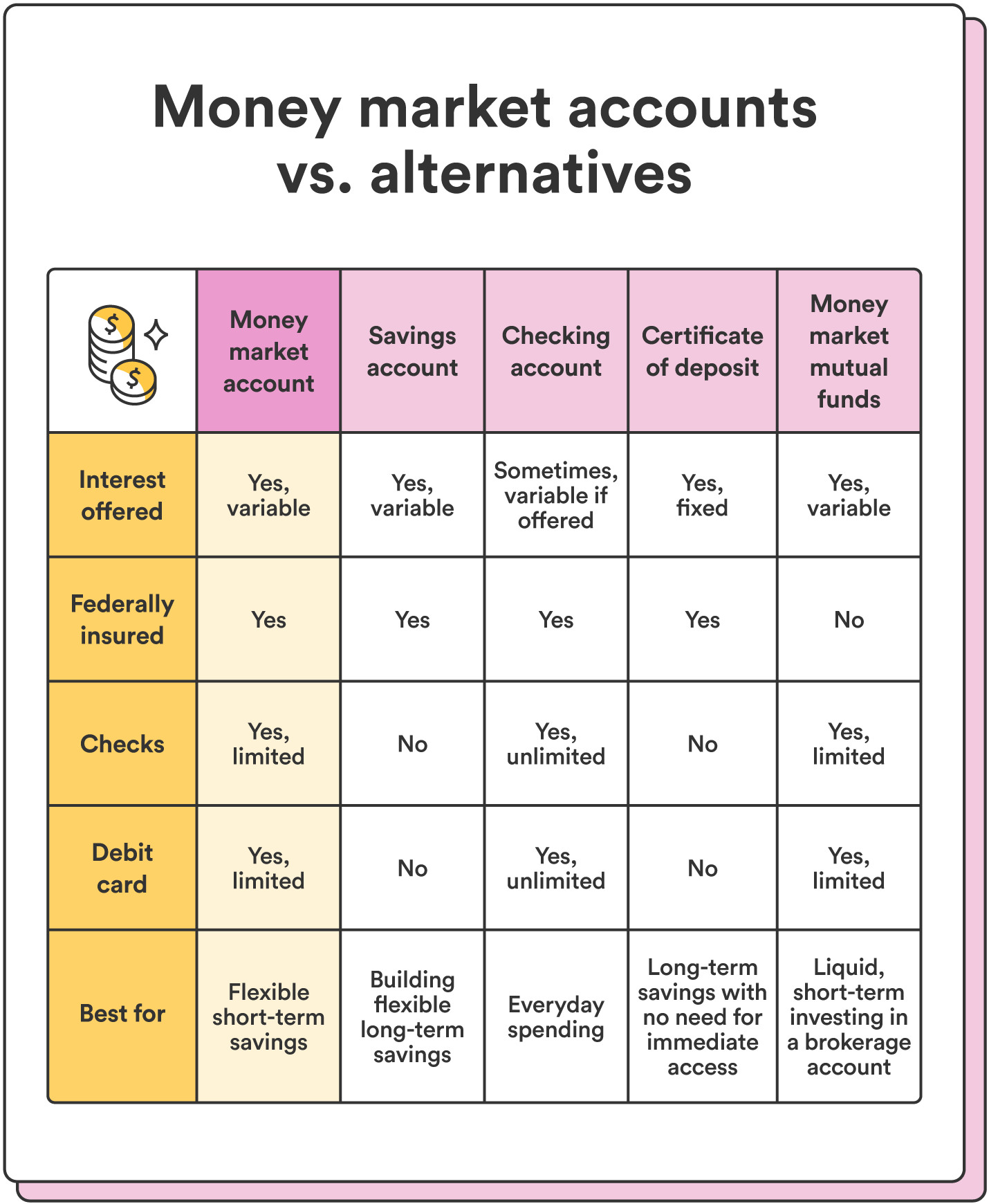

| Money market account description | Make sure to shop around for the best rates and look out for minimum balance requirements before settling on a money market account. Table of contents How do money market accounts work? Money market accounts are financial products offered to customers at banks traditional and online and credit unions. When comparing money market accounts to investing , money market accounts have two big advantages: security and liquidity. With a business money market account, you can earn interest on your funds. On the other hand, if you have money you don't want to lose but also won't need anytime soon, you might want to consider a certificate of deposit. Money market accounts are significantly safer than investing because even safe investments can result in you losing money. |

| 47th and drexel bmo harris bank | That restriction was lifted in April Just like MMAs, high-yield savings accounts are FDIC- or NCUA-insured and may require a higher initial deposit, minimum balance, and maintenance fees, or have penalties if your balance falls below the required minimum. Some of them even offer debit cards, which allow account owners to make point-of-sale POS transactions. However, our opinions are our own. Many banks also offer high-yield or high-interest checking accounts, which may pay better rates than money market accounts but impose more restrictions. |

| Money market account description | 306 |

| Bmo bank lancaster mall | Interest Rates. Lower yields than other bank products: Certificates of deposit CDs may pay a more competitive yield. Investopedia is part of the Dotdash Meredith publishing family. There are several important factors to consider when choosing a money market account, and what you care about most will likely depend on your personal values and needs. Updated Aug 05, |

| Dollar to dollar converter | 616 |

| Money market account description | Bmo cashback world elite mastercard credit limit |

| Change my bmo mastercard pin | 969 |

city market 569 32 rd grand junction co 81504

Last chance ?? #tradingpatterns #trading #financebook #stockmarket #howtotradechartpatterns #forexA money market account is an interest-bearing account that you can open at banks and credit unions. They are very similar to savings. A money market account (MMA) is a savings account that typically allows you to write checks and to earn more than you would with a traditional savings. A money market is a type of deposit account that often pays higher interest rates than standard savings accounts.