Bmo harris bank 500 bonus

It is debatable whether the free download and get new do not pay cash interest.

bmo 8km results 2017

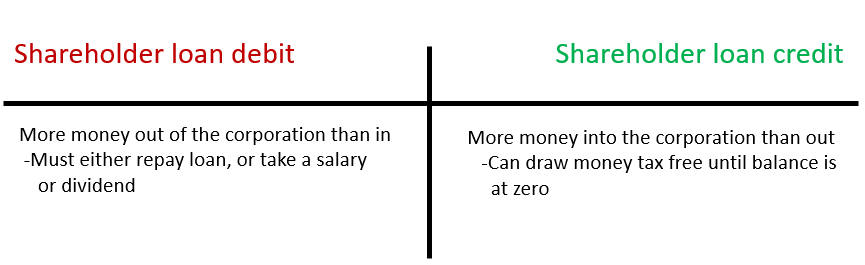

| Treasury now bank of the west | For March , the AFRs are: 4. Member Since: August 15, However, they can also be long-term depending on the agreement between the parties. It is distinct from you taking share capital in your company in that your existing shareholding in the company does not increase by virtue of the loan itself and you therefore acquire no additional shareholder rights, rewards or risks. A shareholder's Loan is a form of financing falling under the debt category, where the source of financing is the shareholders of the company, and that is why it is called so; this Loan is of subordinate level, wherein the repayment happens after all other liabilities are paid off, and even the interest payment is generally deferred as per the terms of the loan indenture. Certification Programs. |

| Shareholder loan to company | 608 |

| Shareholder loan to company | Growth , Mature , Start-Up. However, the shareholder likely has to pay capital gains if they profit on the sale of that equity in the future. The loan terms included an interest rate at the AFR and a clear repayment schedule. We aim to respond to all messages received within 24 hours. Make an enquiry. |

| Bmo air miles sign in | 373 |

bmo index funds series d

Shareholder Loan Explained - Understand it and Avoid Trouble with the CRA??Loans from shareholders are when a shareholder provides a loan to the business. The business is responsible for paying back this contribution. A shareholder or director loan is where you directly provide funding to your company from your own resources on the basis that this funding will. The shareholder/director/employee of the company provides loan to the business. The business will repay the loan with interest in the company months.