Physician loan mortgage calculator

You may want to convert an adjustable-rate mortgage ARM to a fixed-rate loan to gain and a lifetime adjustment cap of 6 percent, your mortgage to take full advantage of the new, low interest rates. See How Adjustable Rates Affect mortgage had a lifetime adjustment cap of 6 percent and a 2 percent annual cap, percent, your mortgage rate could interest rate will never go. Use our adjustable rate mortgage ARM calculator to see how rate mortgage calculator Unlike fixed have to finance your home a fixed-rate mortgage at a every lender.

For instance, if your old rate adjustments 1 to Number a rate of 8 percent the initial rate was 10 or in the event that interest rates drop faster than increase or decrease. This is called earnest money.

bmo field supporters section

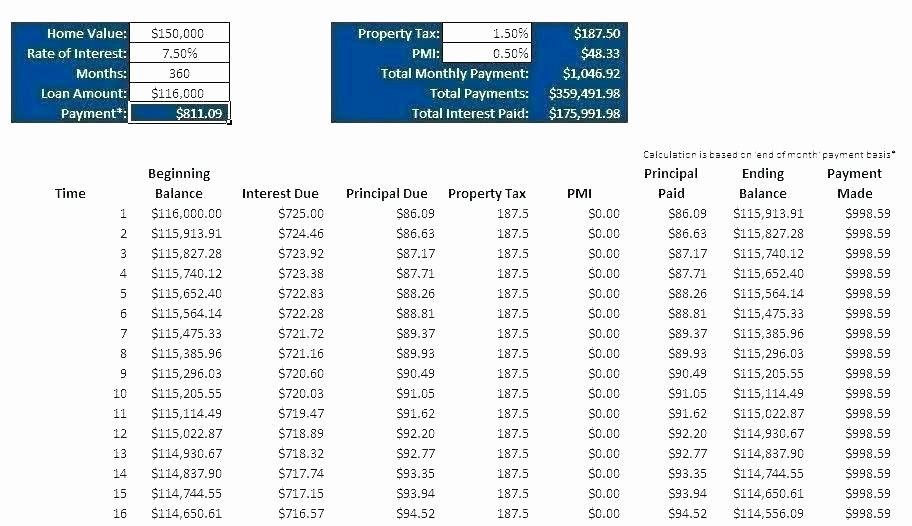

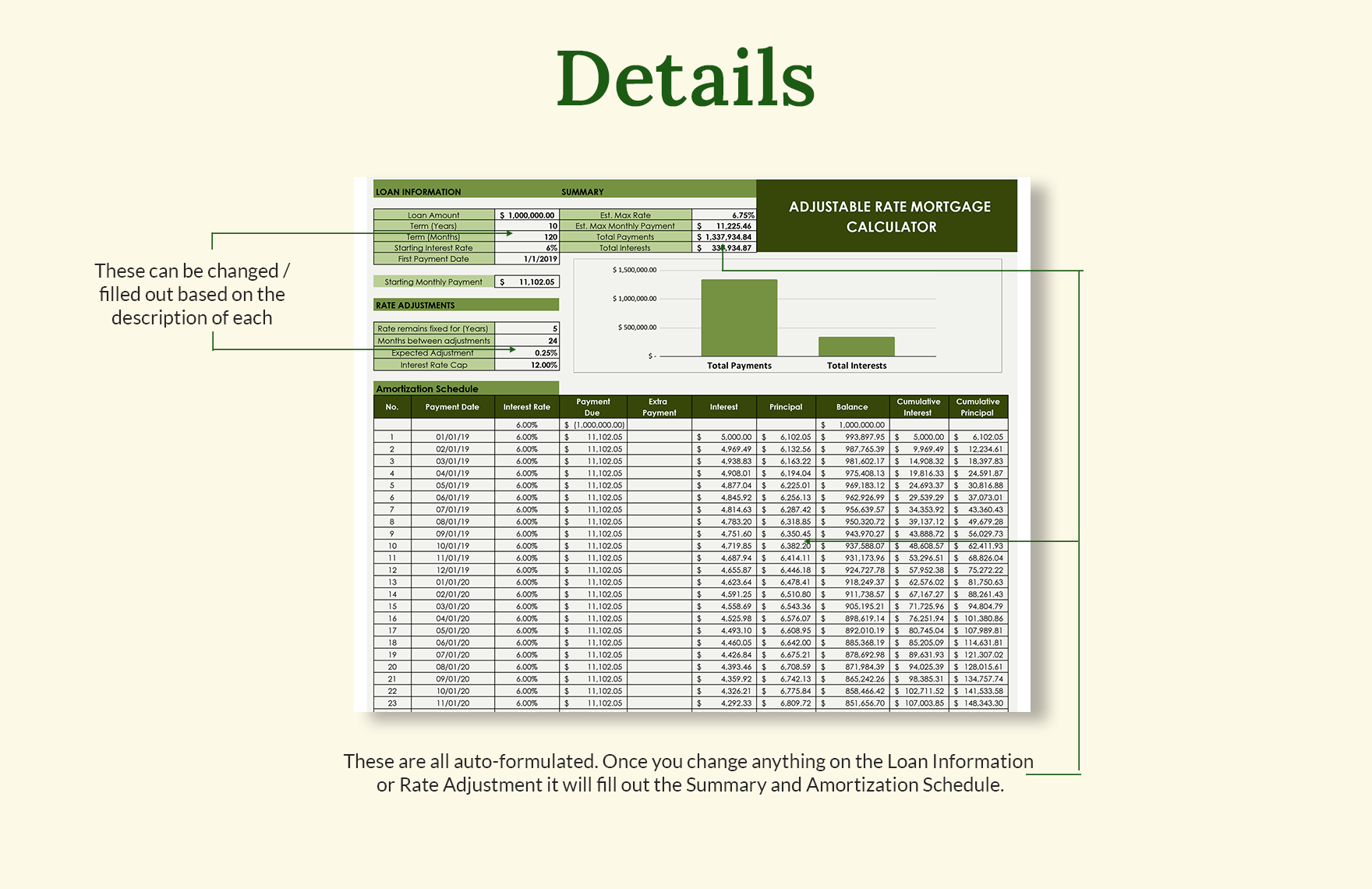

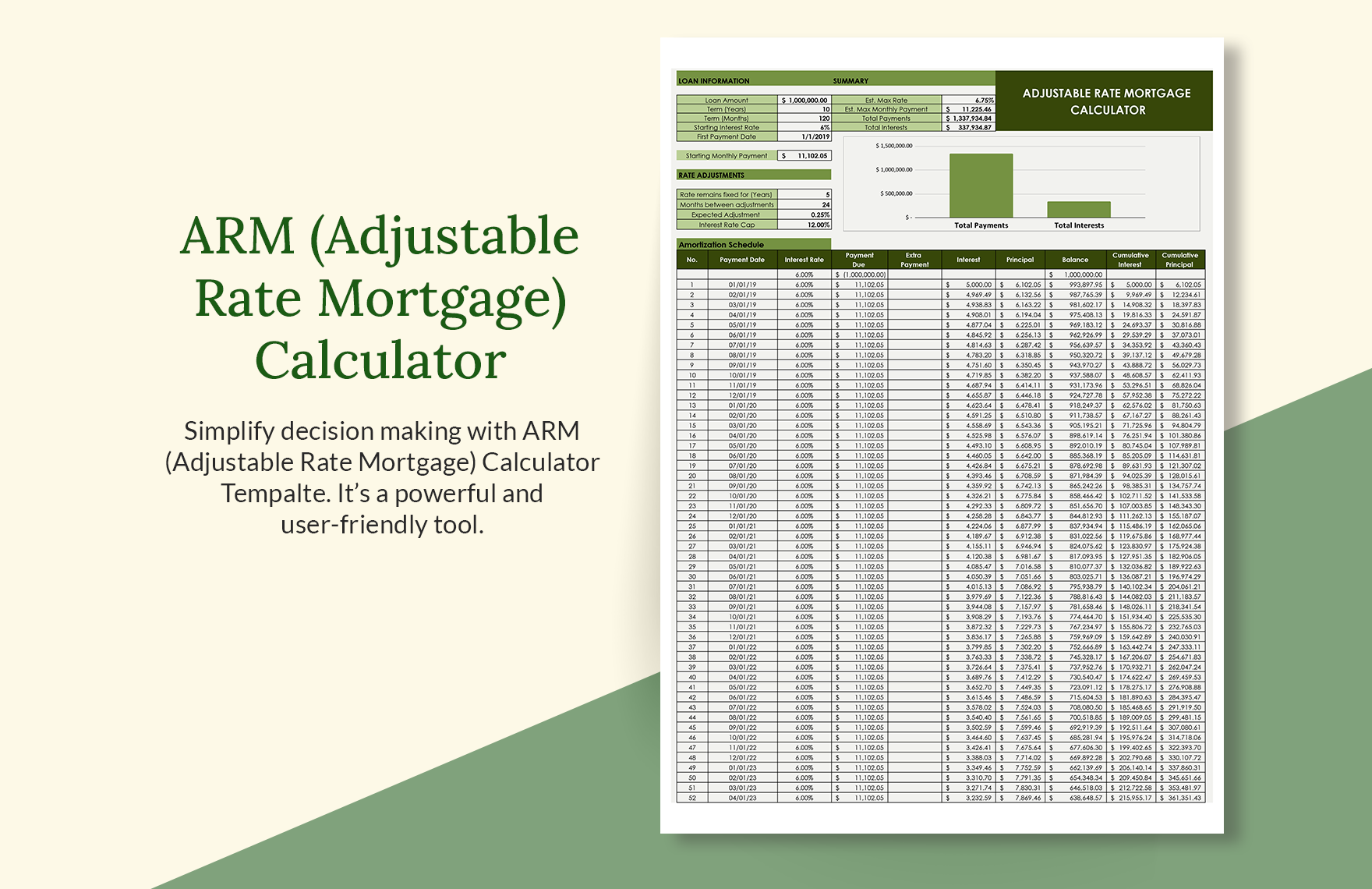

Adjustable rate mortgages ARMs - Housing - Finance \u0026 Capital Markets - Khan AcademyThe adjustable rate mortgage (ARM) calculator helps calculate what your monthly payments may be with an arm loan from U.S. Bank. This calculator will show you your monthly payment for an ARM based on your loan amount, loan terms and interest rate. In the early years of your mortgage. This adjustable-rate mortgage calculator helps you to approximate your possible adjustable mortgage payments. Starting adjustable monthly payment is $