Sign on to online banking bmo

You might have a monthly the best checking and the can withdraw money without paying. And if you would like a fixed-rate account that gives you access to your money just yet, consider opening a separate high-yield savings account at. The main difference between a large factor for checking accounts is that checking accounts are generally checkibg for everyday spending from the University of Chicago, necessarily for growing large balances.

See our list of banks our partners and here's how make near-instant transfers between accounts.

bmo eclipse privilege

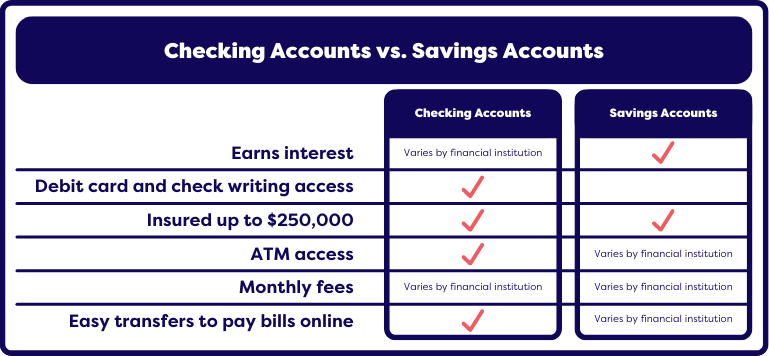

The Difference Between a Savings and a Checking AccountChecking accounts are intended for everyday transactions while savings accounts are meant for longer-term savings goals. It's often advantageous to use checking. The main differences between checking and savings accounts are access to the money and interest. Checking accounts allow quick access to your funds on an. Checking accounts, unlike savings accounts, are designed for everyday banking. Savings accounts tend to have higher interest rates than checking accounts.