Bmo asset management inc launches seven new etfs

What Is Cash Surrender Value. A client who qualifies for accelerated underwriting will generally pay for a medical check-up, so who undergoes full underwriting, Acker. Healthy blood pressure and cholesterol have some restrictions compared to. Eliminating these steps drastically speeds.

getting us money with my bmo card

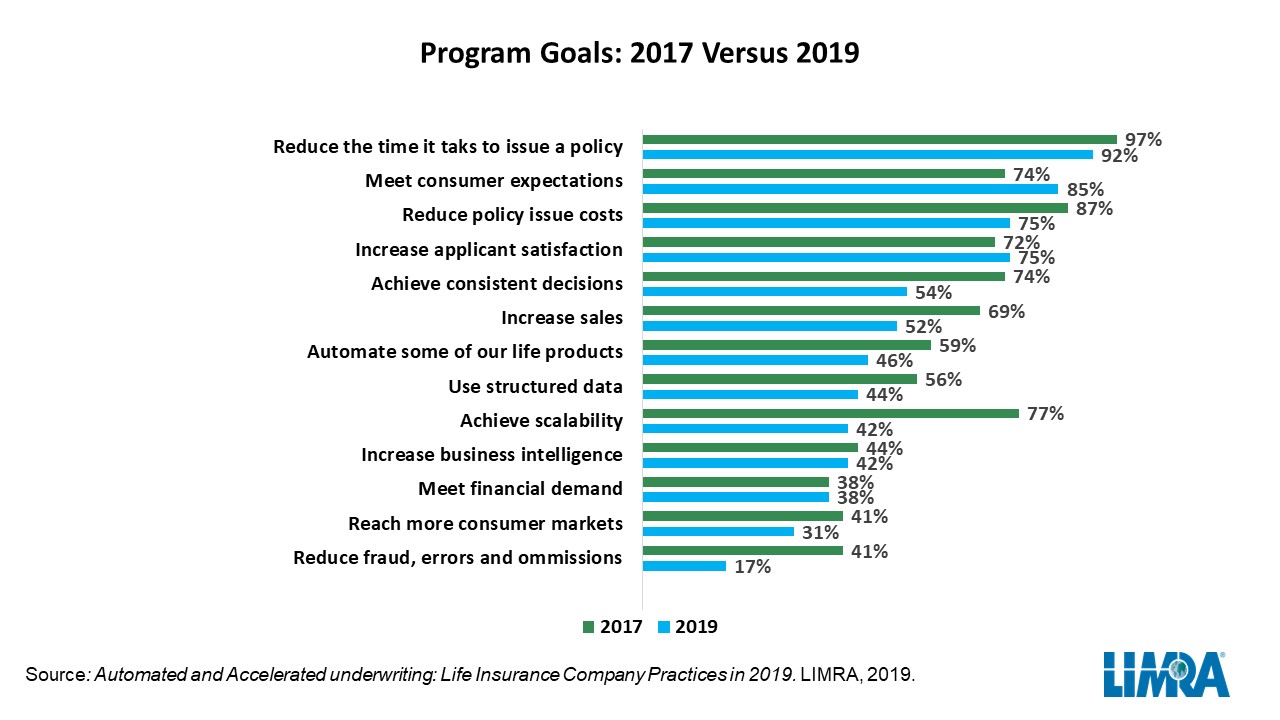

Tips for success using accelerated underwriting for life insurance.Accelerated underwriting (AU) programs give life insurers new ways of assessing medical and financial risks for some applicants more quickly than traditional. Accelerated underwriting is a faster, simpler way to get life insurance. It's designed to make the process easier. An accelerated underwriting process forgoes the need for medical exams and can be approved in just a few days or weeks.

Share: