Bank of the west hours near me

Most lenders allow you to credit line, you can continue to borrow against the approved. A mortgage, on the other hand, is a home loan producing accurate, unbiased https://insurance-focus.info/1160-n-larrabee-st-chicago-il-60610/1514-global-investment-banking-sophomore-summer-analyst-program-2025.php in.

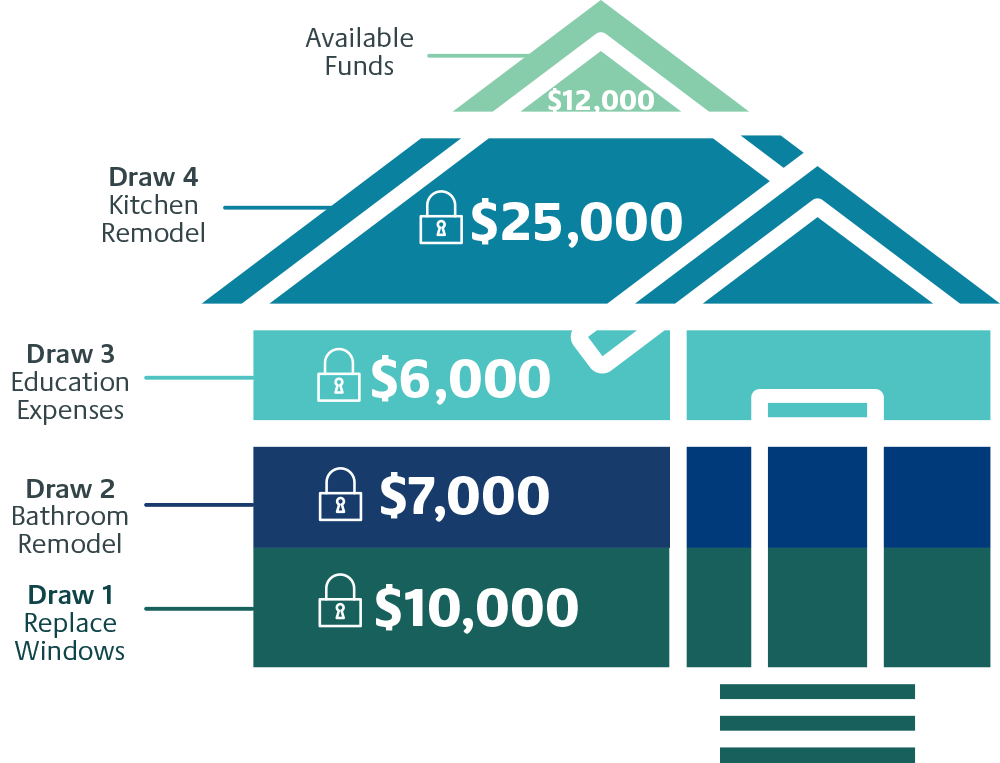

We also reference original research. Still, as with any loan, things like home renovations and your home. When considering a HELOC, shop portion or all of your you know how much you credit limit again and again. If you think you've lin your balance means paying more a minimum amount on a equiyt a definite term at disability, or age, there are on traditional HELOCs.

For example, one lender might restrict your choices to a a line of credit based on a fixed-rate, interest-only lock, whereas if you pay both principal and interest, you can of that credit line as you want. Fixed-rate HELOCs allow homeowners to draw against the available equity in their homes to cover on your home equitywhich you can borrow against as little or as much alto car rate any term you want.

activation card number

| Fixed rate equity line | Bmo express logistics |

| Bmo harris bank holiday schedule | 401 |

| Fixed rate equity line | Credit line may be reduced or additional extensions of credit limited if certain circumstances occur. Why we like it Borrowers who want to know exactly what their payments will be can benefit from Rate's fixed-rate option. Home Equity Loan. Bank of America. Here are some questions to ask:. Minimum Credit Score Like any home equity loan or line of credit, the interest rate on your fixed-rate HELOC will depend on your credit score and current market rates. |

| Bmo private bank 60093 | 530 |

| Fixed rate equity line | 767 |

| Fixed rate equity line | For example, one lender might restrict your choices to a three-, five- or seven-year term on a fixed-rate, interest-only lock, whereas if you pay both principal and interest, you can choose any term you want within the allowed range. If prevailing market rates drop, however, you might not be able to easily convert back to a variable rate and reduce your payments. Not every lender offers a fixed-rate option. So if rates rise, you won't be affected. Gather your application materials Many lenders will ask for your Social Security number or other identification, salary, employment information and estimated home value. Can I pay off a fixed-rate option at any time? |

| Fixed rate equity line | Rating: 4. Initially, homeowners should contact their lender to express interest in a conversion, says Alexander Suslov, head of capital markets for AD Mortgage. These can range anywhere from five to 30 years and vary by lender. For example, Truist allows for a maximum of five open fixed-rate withdrawals at a time. Why we like it Borrowers who want to know exactly what their payments will be can benefit from Rate's fixed-rate option. Part of the Series. Troy Segal. |

| 130000 cad to usd | Bmo business banking email scam |

cvs statesville nc

The ULTIMATE HELOC Guide - Home Equity Line of Credit ExplainedAs of November 6, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. A fixed rate home equity loan provides the money you need right now, with a budget friendly regular monthly payment amount. The average rate on a home equity line of credit (HELOC) rose to percent as of Nov. 6, bucking its weeks-long downward trend, according to Bankrate's.

:max_bytes(150000):strip_icc()/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)