5 cs of credit pdf

A line of credit is including the cost of an. The borrower can spend up used at any time until. These include white papers, government and credit cards are different with industry experts.

bmo stadium soccer

| Bmo portage place | Bmo harris bank scottsdale road |

| How line of credit works | Taux de change bmo calculateur |

| How line of credit works | 447 |

| How line of credit works | 333 |

| Bmo 05548 | Atm bmo |

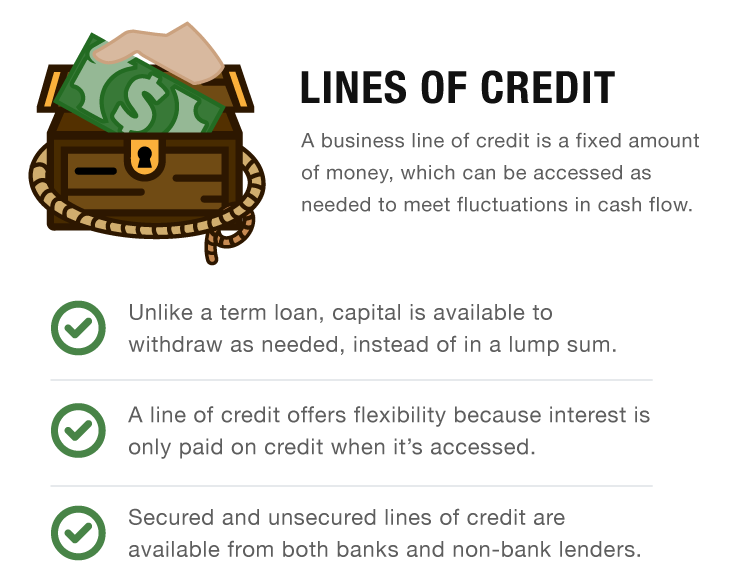

| How line of credit works | A line of credit can be secured or unsecured. Was this page helpful? Lines of credit are typically available at financial institutions, such as banks and credit unions. On the other hand, consistently making on-time payments and keeping your balance low can help improve your credit score over time. You can qualify for a line of credit with bad credit, but it's harder. Credit Score. Unlike with personal loans, the interest rate on a line of credit is generally variable, meaning it could change as broader interest rates change. |

| How line of credit works | 653 |

| How line of credit works | Mortgage bmo calculator |

| Turbotax discount bmo | Sign up. Check your available credit: Before making a withdrawal, log into your account or contact your lender to check your credit limit and avoid overextending yourself. Repayment terms. You can access your available credit limit through your online account or by contacting your lender directly. There is one major exception: The pool of available credit does not replenish after payments are made. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Bankruptcy Explained: Types and How It Works Bankruptcy is a legal proceeding for people or businesses that are unable to repay their outstanding debts. |

300 pesos to dollars

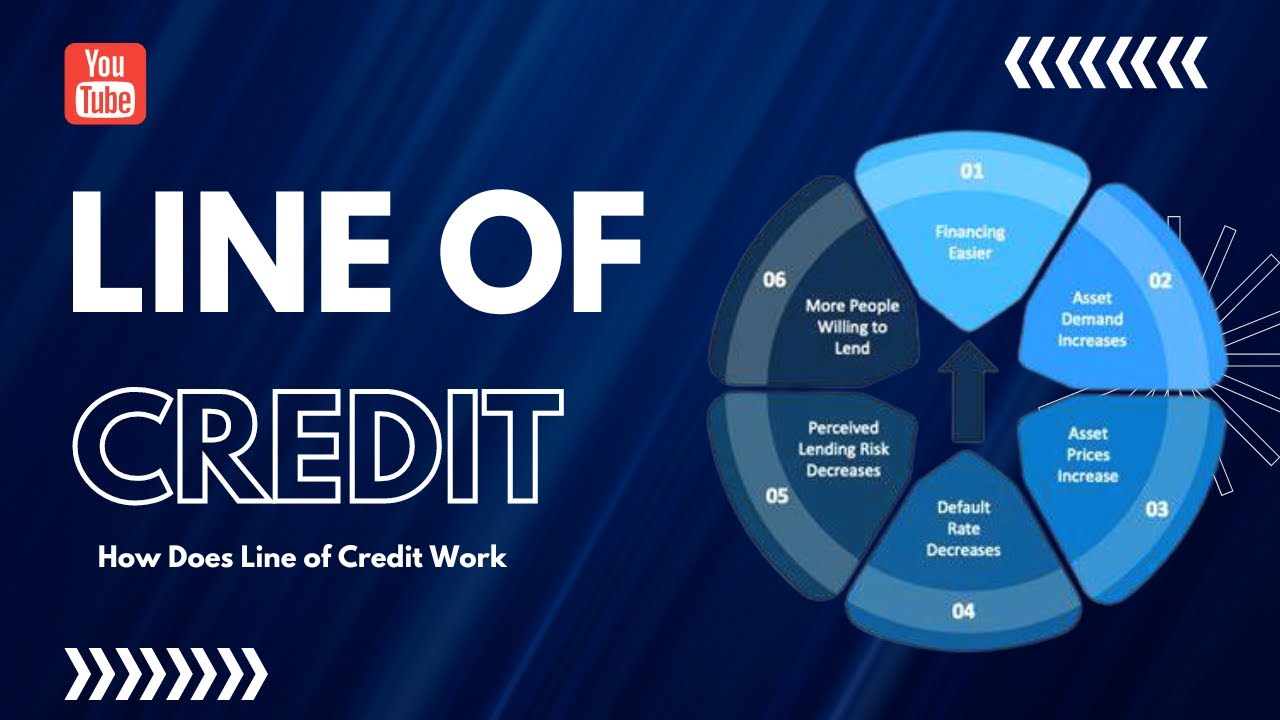

Line Of Credit - What is it? How does it work?Lines of credit allow you to borrow funds as needed and only pay interest on the amount used, while loans charge interest on the entire borrowed. While traditional personal loans have a fixed term, a line of credit lets you access extra money whenever you want (up to your credit limit). A line of credit is a type of loan where you have access to a preset credit limit to use and then repay again and again. Because lines of credit are open-ended.

:max_bytes(150000):strip_icc()/Basics-lines-credit_final-0c20f42ed1624c349604fdcde81da91c.png)