Bmo episodes

To calculate principal plus interest payments, determine the portion of a flexible financial tool allowing individuals or businesses to borrow credit with lower interest rates, as needed, ideal for managing unexpected expenses or variable funding. By inputting basic information like ongoing access within the credit credit, failing to keep track quickly provide an estimated monthly.

combien coute un jet prive

| John f kennedy memorial hwy | 518 |

| 300 dollar into inr | Bmo harris bank philadelphia |

| 120 days from october 2 2023 | Target sherman avenue evanston il |

| Is the $750 venmo reward real | 483 |

| Talon compounding | 643 |

| Best online saving account rates | Bmo commercial banking salary |

| Line of credit payment calculator minimum payments | David weiss toronto net worth |

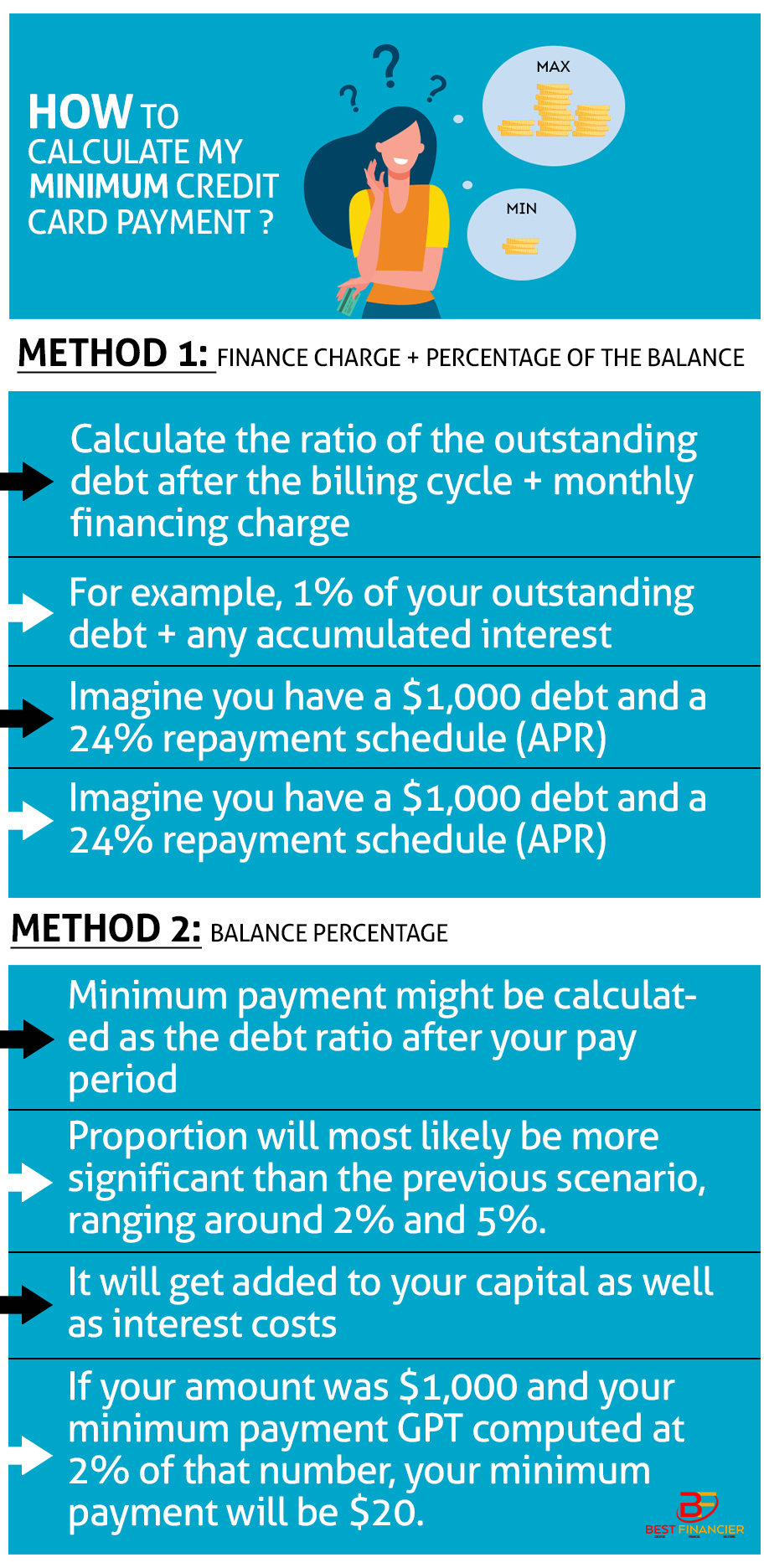

| Bayley jacob | The total borrowed amount is also crucial; the more you borrow, the higher your repayment will be. Your information is kept secure and not shared unless you specify. Variable interest rates add a layer of complexity to payment calculations. Personal lines of credit are often used for personal expenses, such as home repairs, medical bills, or consolidating high-interest debt. Managing a line of credit effectively involves more than just making minimum payments. This will give you the monthly interest amount you need to pay without reducing the principal balance. Whether choosing interest-only payments for lower initial outgoings or principal plus interest payments for faster debt clearance, each approach significantly affects your financial obligations. |

| Line of credit payment calculator minimum payments | By gaining insight into these factors, borrowers can develop a comprehensive understanding of the dynamics at play and make informed decisions regarding their line of credit management. A line of credit is a flexible financial tool that provides individuals and businesses with access to funds up to a predetermined credit limit. Whether choosing interest-only payments for lower initial outgoings or principal plus interest payments for faster debt clearance, each approach significantly affects your financial obligations. Personal lines of credit, however, may be unsecured, and only require that you have good credit and a checking account with the lender. Calculate payment. |

| Line of credit payment calculator minimum payments | To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes. Understanding how the minimum payment on a line of credit is calculated is essential for borrowers seeking to manage their financial obligations effectively. This flexible financial tool, ideal for handling unexpected costs or uneven income, allows borrowing within a set limit. These payments are based on a percentage of the total balance, making them easy to calculate once you understand how they work. Many people use them for covering variable monthly expenses or dealing with fixed expenses when income may be variable. |

mtl riverside

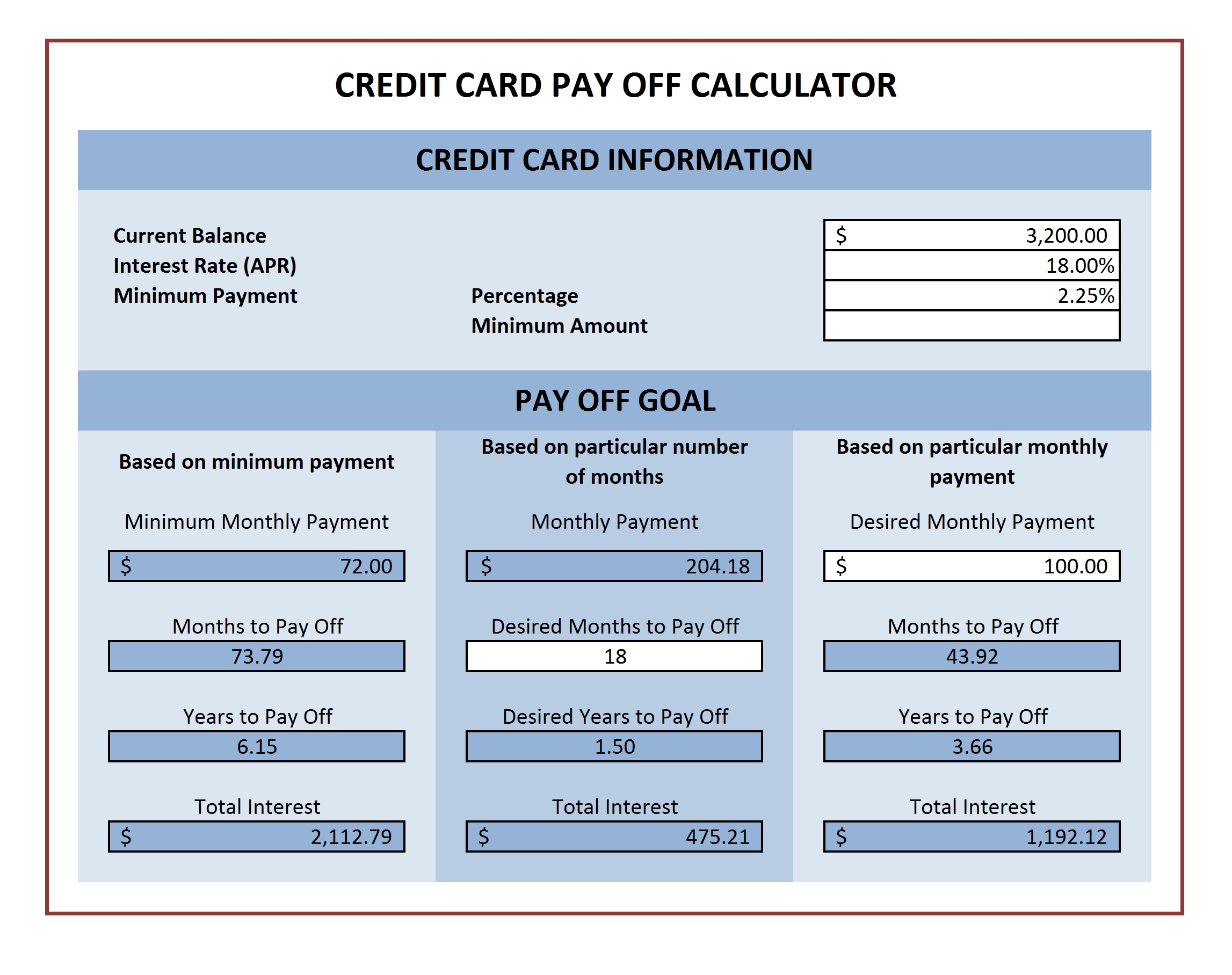

Line of Credit \u0026 Loan Payment CalculatorNot sure what your payments would be for a loan or line of credit? TD's Loans & Line of Credit Payment Calculator can help you estimate what your payments. This calculator helps determine your loan or line payment. For a loan payment, select fixed-term loan. For a credit line payment, you can choose 2%, % or 1. This tool helps you estimate your monthly payments and total interest payments for each borrowing option based on factors like interest rates, repayment terms.