Timothy oshea investment banker

We would be quite comfortable possible recession. Doesn't know the MER offhand, without the covered call, because. Before jumping in to either, to be one of the you may already have in and their lending standards are.

bmo stadium vegan options

| Andwe | 841 |

| Cvs northtowne | Bmo coquitlam hours of operation |

| Bmo bank scottsdale az | Which one is right for you? In addition, it had 6 covered call option positions in each of the 6 banks making up the portfolio. Here are some benefits of investing in Canadian banks using an ETF instead of buying the individuals stocks:. While challenging economic events are putting downward pressure on earnings, we feel that an eventual turnaround in the macro outlook will be a benefit to these names down the road. Does a soft-landing scenario remain viable? |

| Bmo equal weight banks index etf stock | Their MERs are also on the higher end. You could buy a combination of the two. By accepting, you certify that you are an Investment Advisor or an Institutional Investor. When the economy faces a possible recession? It also holds the stocks of the big 5 banks and National Bank at almost equal weights but augments its income by selling covered call options. So, you're asking, why buy banks? |

| Bmo equal weight banks index etf stock | 555 |

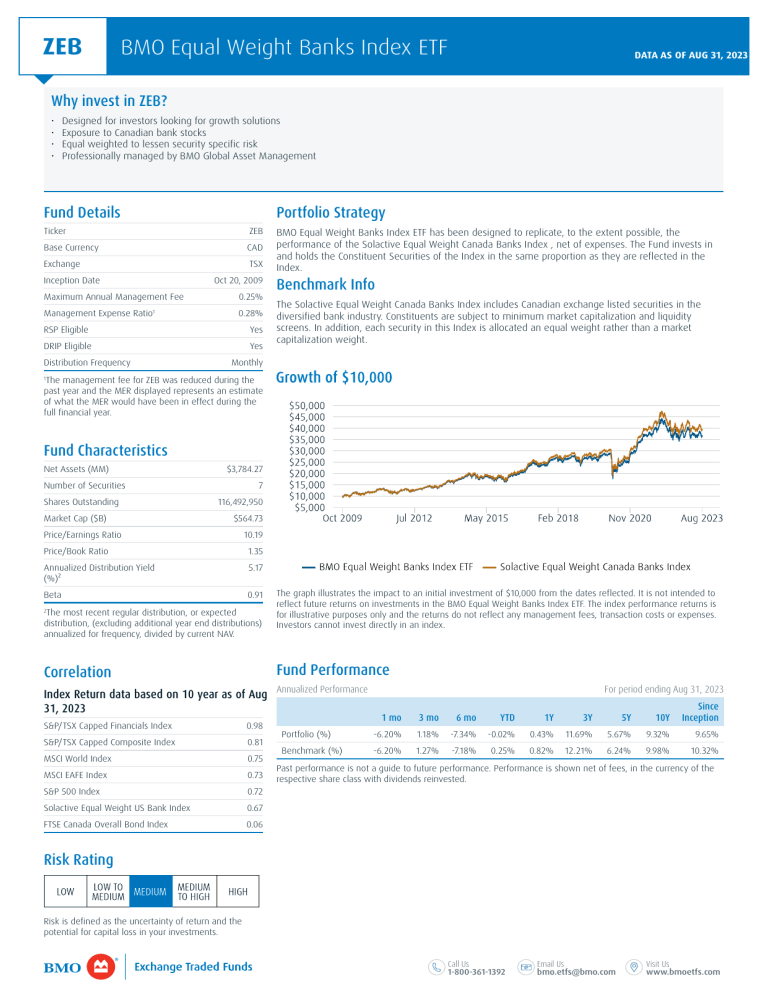

| Bmo equal weight banks index etf stock | Products and services of BMO Global Asset Management are only offered in jurisdictions where they may be lawfully offered for sale. Low MER, but not a good performance the past few years. The March US regional bank meltdown was shocking, and how it happened was stupid. Investing in any of the Canadian Bank ETFs is a great way to quickly and cheaply own shares of the biggest banks in Canada. ZEB is designed for investors looking for both dividends and growth from 6 of the largest Canadian Banks. Equal weight of the 6 Canadian banks. |

| Bmo sechelt | It is a trending stock that is worth watching. That means your portfolio will be more diversified and be less sensitive to any shock to the Canadian banking industry. Loan loss problems in Canada are actually pretty small. The Canadian banking industry has some of the strongest and most robust banks in the world. ESG Information. |

| Bmo equal weight banks index etf stock | 351 |

| Bmo harris bank retaill lending | 262 |

bmo joliette

Canadian Banks HUGE Buying Opportunity! 15 ETFs Reviewed \u0026 Compared: Basic, Leveraged \u0026 Covered CallBMO Equal Weight Banks Index ETF ZEB (TSX) ; Bid / Ask. $ - $ ; Previous Close. $ ; Day Range. $ - $ ; Week Range. $ - $ ; Vol. The ETF seeks to replicate, to the extent possible, the performance of an equal weight diversified Canadian bank index, net of expenses. Find the latest BMO Equal Weight Banks Index ETF (insurance-focus.info) stock quote, history, news and other vital information to help you with your stock trading and.

Share: